Content Attributes

What are revolving loans and spot loans? What is the difference between revolving credit and spot loan? Which loan type should be preferred when taking a loan?

Today, many people apply for loans to meet their urgent cash needs and meet their financial needs. That is why many people benefit from many types of loans created by banks. In order to increase the number and satisfaction of customers in banks. It provides various loan opportunities for every need and offers them to its customers in a campaign manner.

Rotative and Spot Loans are among the most preferred loans and they are researched by many people. It is necessary to act very carefully and cautiously at the point of preference of these loans. Which have quite different features from each other.

In addition, it will be beneficial for you to have complete information about loans. If you are doing research on Revolving Loan and Spot Loan, You can listen to our article. In this article, we will talk about the Differences Between Revolving Loan and Spot Loan and their details.

Differences Between Revolving Loan and Spot Loan

Before we talk about the differences between Revolving Loan and Spot Loan. We will try to provide you with some outstanding information about Revolving Loans and Spot Loans. In addition, you need to act very cautiously and consciously when applying for both types of loans.

At this point, our suggestion to you is to apply after discussing the relevant loans with your bank and after receiving detailed information. Let us state that both types of loans, which are generally preferred by commercial enterprises, have different factors and features. If you are wondering about Rotative and Spot Loans, let’s look at the details together.

What is Revolving Loan?

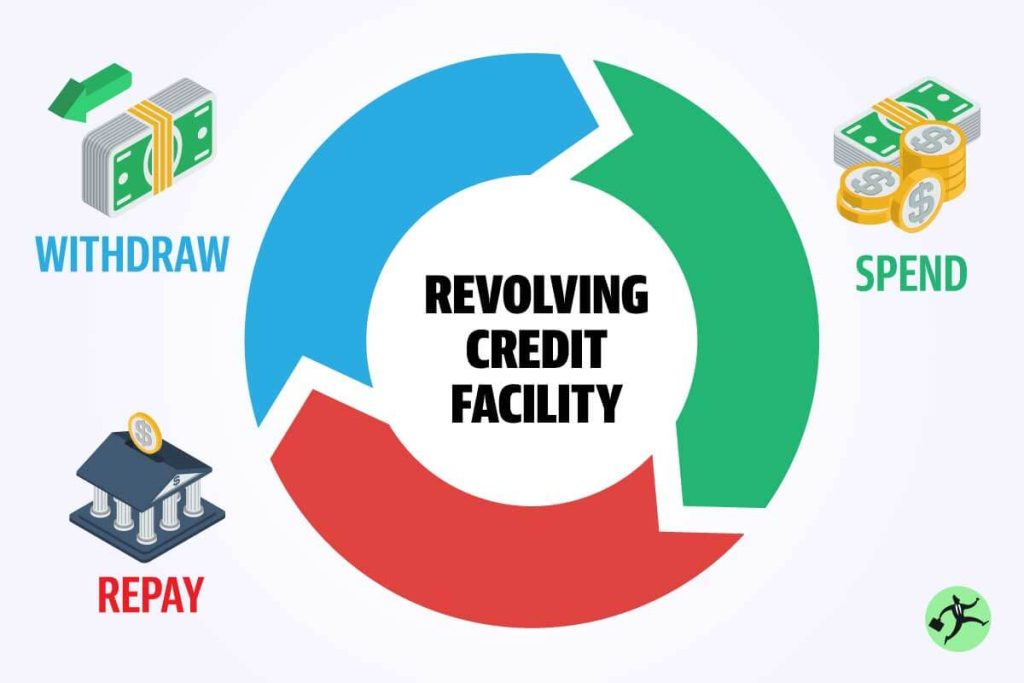

Revolving loans are a type of loan with unstable interest rates and varying maturity periods. Banks may change their interest and maturity rates due to the economic fluctuations experienced in the countries where they are located. This is the most prominent feature of revolving loans. Revolving loans are generally preferred by businesses in terms of providing products and eliminating costs.

However, in this type of loan, there is also the risk of demanding your payment by the bank without a due date. Before applying for a revolving loan, we strongly recommend that you contact your bank and get preliminary information. There are some issues that commercial enterprises should also pay attention to in revolving credit.

What is Spot Loan?

Spot loan is a type of loan defined by banks as short-term today. The most distinctive feature of spot loans is that their interest and maturity rates are fixed. This does not affect the person requesting the loan in any economic fluctuation that may be experienced. In addition, the other great advantage is that the maturity rate is fixed, and banks cannot demand short-term payments.

This also closes the path for early closing of the spot loan. The most important point to be aware of here is that it is possible to close the spot loan early. However, since the interest rate and maturity are fixed. There is no early closing discount for the amount you will pay.

You have to pay the fixed interest rate that you indicated in the application. In addition, we can say that spot loans have more interest amounts than other loan types but are not affected by any economic change. While choosing this loan type, it will be beneficial for you to get help from an expert financier.

Differences Between Revolving Loan and Spot Loan

Above, we have made definitions of Rotative Loan and Sports Loan under headings. The biggest difference between the two loans is that the interest and maturity rates are fixed in one and variable in the other. While interest and maturity rates vary in revolving loans, interest and maturity rates are fixed in spot loans.

In addition, Revolving Loan can demand the full fee before the bank is due. You have to pay all interest rates when you want to close the spot loan early. These are among the most important differences that distinguish Spot Loans from Rotative Loans. In addition, we can say that there are huge differences between the two loans in terms of features.

In addition, we can say that the Spot Loan Interest rates are higher than the Rotative Loan. Which is mainly due to the fixed interest rate in spot loans. Therefore, no matter which loan you choose, you need to take very careful and conscious steps.

Do I Have a Spot Loan or Should I Prefer Rotative Loan?

If I don’t have spot credit, is it a revolving loan? The answer to the question is completely hidden in you. If the economy in your country is constantly changing and there is a certain uncertainty. We recommend that you use Spot credit.

However, if there are no big changes and the cruise continues at a certain rate. You can choose the Rotative Credit here. In our market and loan evaluations, we can say that the interest rates of the Spot Loan are higher than the Rotative loan.

Before applying for Spot and Revolving Loans, which are generally preferred by large commercial enterprises. The economic conditions should be followed and a decision should be made about which loan will be preferred. In this process, choosing experts who closely follow the economy will provide you with a great benefit.